ONESOURCE Corporate Tax features

Empower your tax team with agile cloud solutions

Transform your tax management with comprehensive services, featuring business tax deductions, income tax compliance, and global company tax rate tracking

Secure and Controlled Access

Protect sensitive data with advanced security and role-based access for trusted computations.

- Advanced Security Features: Ensures only authorised users can access the system, safeguarding sensitive tax information.

- Differentiated Access Levels: Provides varying levels of access, ensuring personnel have appropriate data access based on their role.

- Confidence in Data Protection: Protects tax data integrity, fostering trust in the accuracy of final tax computations.

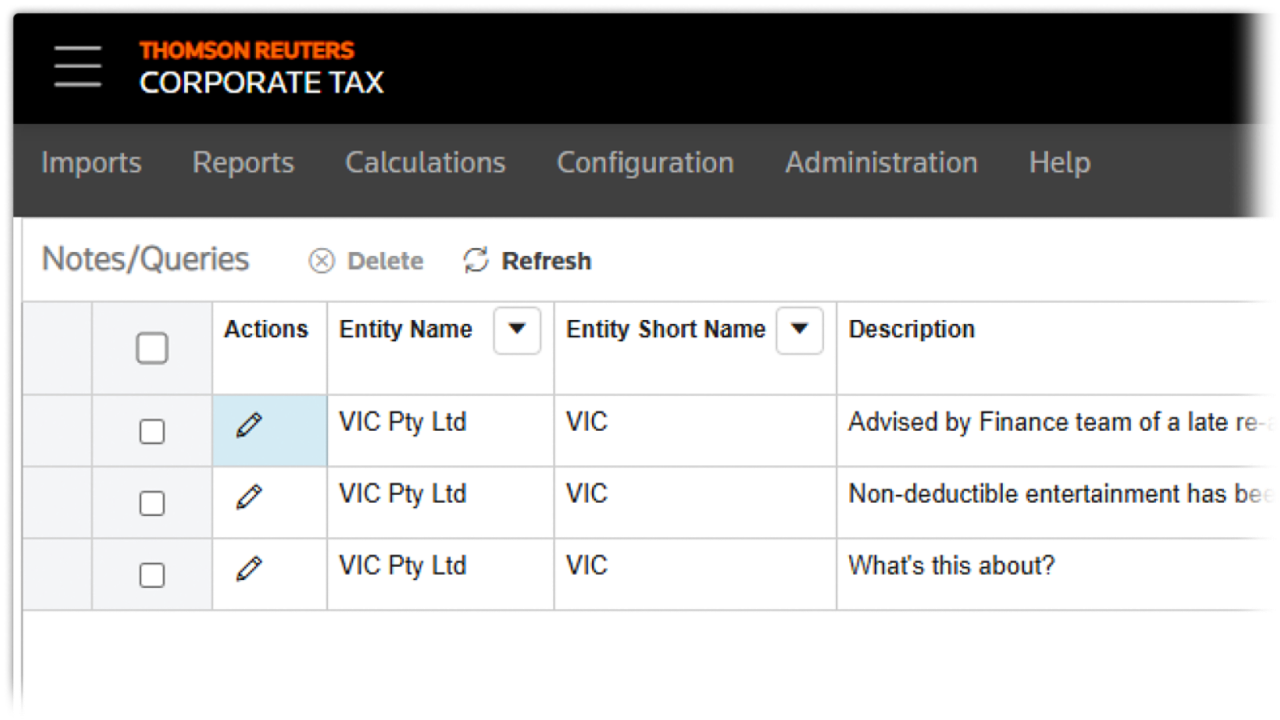

Comprehensive Audit and Compliance Tools

Ensure transparency, accuracy, and compliance with detailed audits and discrepancy alerts.

- Detailed Audit Trails: Keeps a comprehensive record of all changes, ensuring transparency and accountability in tax processes.

- Mandatory Journal Entries: Requires journal entries for any account balance adjustments, maintaining financial accuracy and control.

- Discrepancy Alerts: Provides warnings for schedule balance discrepancies and cross-references with tax computations and ITR14 to ensure compliance.

Talk to an expert

Streamline your tax operations and enhance accuracy with ONESOURCE Corporate Tax!

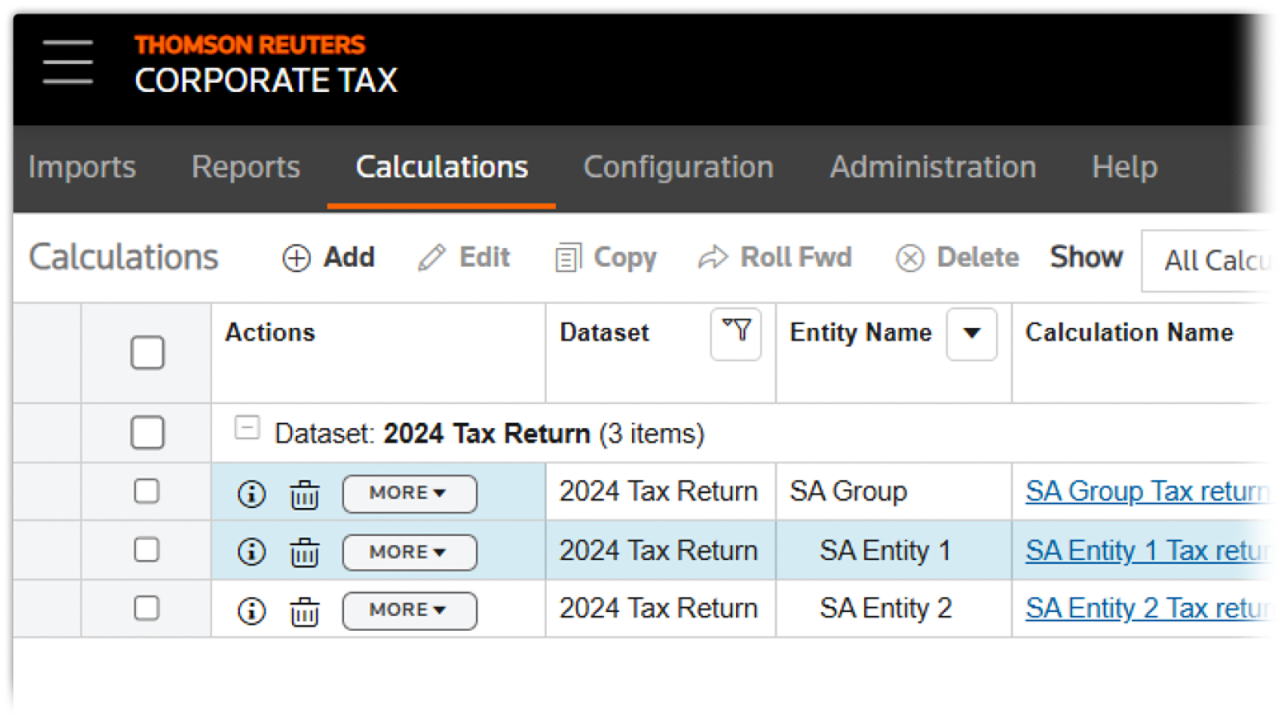

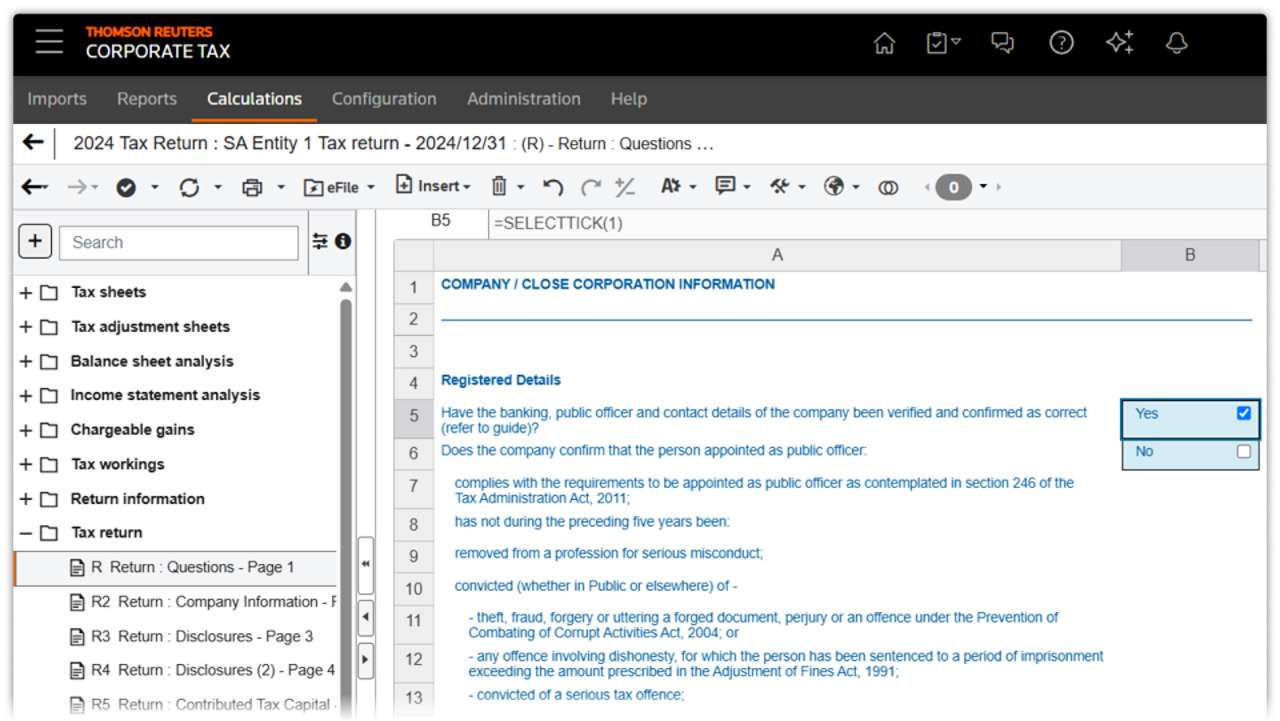

Streamlined Tax Automation and Management

Automate tax tasks, import data seamlessly, and manage data centrally for efficiency and accuracy.

- Automated Tax Processes: ONESOURCE automates tax computations, form completion, and schedule preparation, reducing manual errors and saving time.

- Efficient Data Imports: Integrates with financial systems for seamless data imports, facilitating accurate and automated tax calculations.

- Centralised Data Management: Stores tax information centrally, rolling forward closing balances and enabling easy access and query resolution.

Frequently asked questions

ONESOURCE Corporate Tax manages updates to tax regulations and policies by leveraging industry-leading insights and content, vetted by experts to ensure adherence to the latest African tax standards, which may include VAT, corporate income tax, and other regional tax obligations. The system is designed to automatically integrate these updates, delivering timely notifications and alerts to keep you informed of any changes. This helps you focus on your business while staying compliant with the dynamic regulatory landscape across African countries.

ONESOURCE Corporate Tax provides robust reporting capabilities designed to support tax analysis and planning. It offers a variety of standard and customisable reports that enable users to analyse tax data, monitor compliance, and assess tax liabilities. These reports can help identify trends, facilitate strategic tax planning, and ensure accurate financial reporting. Additionally, the software supports data visualisation and dashboard features to provide clear insights into tax positions and potential opportunities for optimisation.

ONESOURCE Corporate Tax is designed to integrate smoothly with various financial systems and tools to enhance efficiency and accuracy. The software typically offers integration capabilities through standard data exchange formats and APIs, allowing it to connect with common ERP systems, accounting software, and other financial tools. This integration facilitates the seamless transfer of data, reducing the need for manual data entry and minimising errors. For specific integration details, it's recommended to consult with Thomson Reuters directly or refer to their technical documentation and support resources to ensure compatibility with your existing systems.

ONESOURCE Corporate tax enhances data accuracy and accountability by providing a comprehensive audit trail that records all user activities and changes. This feature links numbers to their original sources, reducing the risk of errors. Additionally, it offers granular access controls, allowing administrators to assign specific permissions to users based on their responsibilities, ensuring secure and appropriate data handling.

Experience it for yourself

Streamline your tax operations and enhance accuracy with ONESOURCE Corporate Tax!

Have questions? Contact a representative