ONESOURCE Corporate Tax

The direct tax lifecycle, re-imagined!

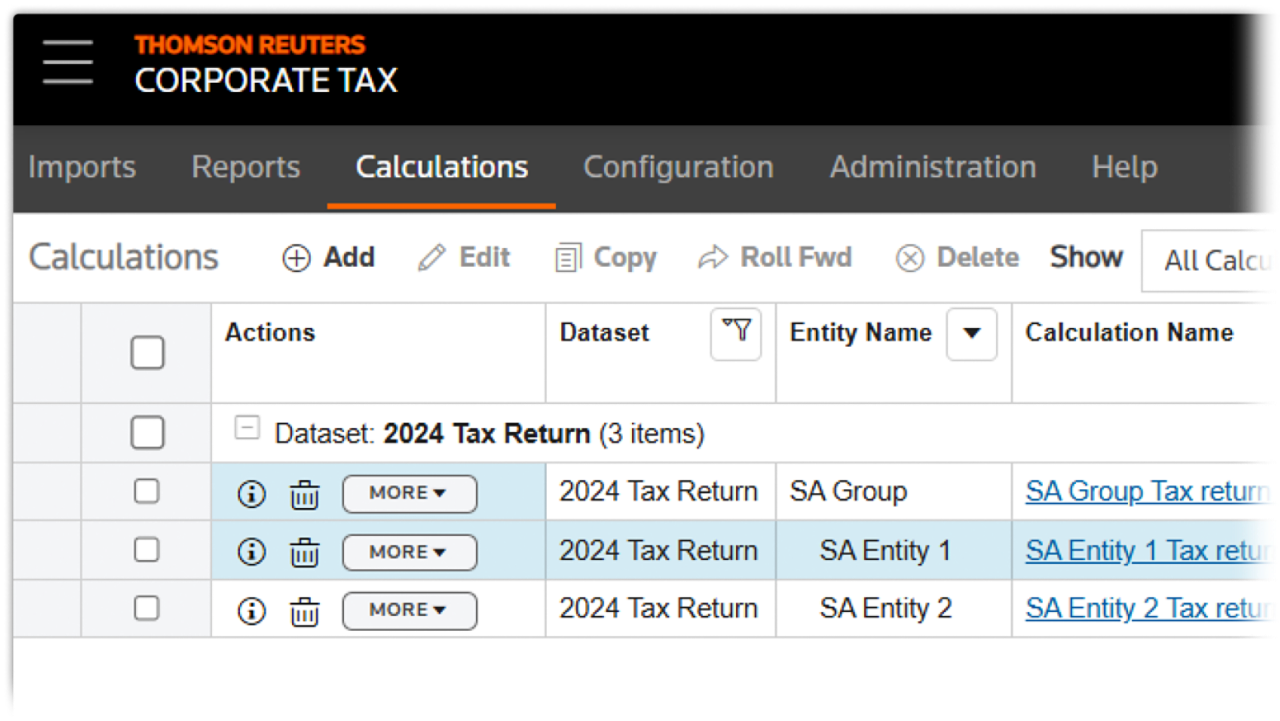

Discover a tailored tax solution for South African companies with SARS tax returns which require submission to the South African Revenue Service

Easy compliance

Stay ahead with expert tax content and nimble cloud technology. Automate calculations and generate tax returns and pre-configured income tax notes, with the flexibility to cater to your group structure. Streamline tax dataflows with integration and reporting tools.

Streamline work, supercharge data

Save time and enhance data synergies with intuitive corporate tax automation. Roll forward all opening balances, custom workpapers, notes and attachments to the next reporting period. Ensure accuracy with pre-filled SARS forms, built-in e-filing validations, and optional e-lodgement of tax returns with the SARS.

Better control

Elevate your tax strategy with powerful modelling and forecasting. Ensure scrutiny-readiness with comprehensive audit trails and robust data management. Enjoy full data traceability for confident decision-making.

Discover a tailored tax solution for South African corporations

Greater agility and scalability

Empower your corporate tax team to work flexibly and securely in the cloud, accessing calculation data anytime, anywhere with a browser and device agnostic web-based platform.

Best-in-class content

Rely on trusted content, built and updated by our in-house specialists to ensure you are tax compliant with the latest tax laws and filing requirements across various jurisdictions.

One-step roll forward

Instantly roll forward all opening balances, customised workpapers, notes and attachments to the next tax reporting period.

Efficient compliance reporting

Stay compliant with the latest requirements for business-to-government reporting. Import your tax data into ONESOURCE E-Filing Manager to easily e-lodge your reports with the relevant tax authorities.

Local support

With an South African based support desk, access localised support at the speed of business.

Connectivity with APIs

Integrate our corporate tax software with your existing systems for effortless data sharing. Streamline your workflows through intelligent automation.

Talk to an expert

Streamline your tax operations and enhance accuracy with ONESOURCE Corporate Tax!

What do our customers think?

ONESOURCE works for us because it makes our job easy. My time shouldn't be spent trying to understand how software works...it gives us peace of mind. We're not answering questions all day, we're not spending countless hours trying to file the return [which] should be the easiest thing to do.

Andrea Sype, Tax Manager, HCR ManorCare

Frequently asked questions

ONESOURCE Corporate Tax is a comprehensive tax management solution that improves the efficiency of tax departments in calculating and submitting their returns and giving the user confidence in the final tax computation. ONESOURCE Corporate Tax provides easy to use features that guide users through the complete process including:

- Warnings are provided should schedule balances not agree to the trial balance and schedule amounts are cross-referenced to the tax computation and ITR14.

- The software also assists the user to identify the disclosure schedules required to be completed for SARS and allows supporting information or documentation to be stored.

- Advanced security features limit access to authorised users and allow for differentiated access to different levels of users.

- Users can use the navigation pane with folders to easily find required schedules, allowing more time to analyse detail.

- Integrated database solution enabling year end or interim tax computations, tax return preparation, deferred tax computation and tax administration.

- Accurate tax information when you need it for internal reporting, year end and tax return calculations and ITR14 preparation.

- Enables SARS ITR14 disclosure requirements and tax legislation changes.

Companies should strongly consider the need to invest in technology to ensure they have the ability to submit accurate and timely corporate tax information. The financial and reputational risks faced by companies from errors or omissions in their tax processes and submissions need to be addressed and managed by a robust tax system. ONESOURCE Corporate Tax solution from Thomson Reuters helps South African companies with SARS tax returns they submit to the South African Revenue Service. Tax in South Africa has become vastly more complex over the past decade and with improved collection and audit capabilities from the tax authorities.

Automation in corporate tax processes is essential due to the increasing complexity of tax regulations and the demand for greater transparency and accuracy. Manual processes are time-consuming and prone to errors, diverting valuable resources from strategic tasks. By automating tax workflows, companies can ensure compliance, reduce risk, and improve efficiency. This allows tax teams to focus on value-adding activities, such as strategic planning and analysis, ultimately driving better business outcomes.

Related products

Automate tax provisioning with accurate estimates using intelligent data filtering and drill down capabilities so you can file earlier and close faster.

Workflow software that combines document, data and task management, plus collaboration tools.

Ready to transform your tax process?

Streamline your tax operations and enhance accuracy with ONESOURCE Corporate Tax!

Have questions? Contact a representative